Has an accounts receivable turnover ratio of 30. Mostly this analysis is considered in terms of evaluating the context of turnover. This concludes our discussion of the three financial ratios using the current asset and current liability amounts from the balance sheet. Balance Sheet Ratio Analysis. Risk-free investment such as a bank savings account the owner may be wiser to sell the company put the money in such a savings. Balance sheet ratios are the. An Accounts Receivable Turnover ratio of 45 means that it takes the company 45 days on average to collect its receivables. It uses to analyze the number of times that net credit sales during the period are collected based on the relationship between net credit sales during the period and averaged accounts receivable at the end of the period. For analysis purposes accounts receivable tend to be an important metric because it reflects the companys overall cash and liquidity position. As you can see in the example below the accounts receivable balance is driven by the assumption that revenue takes approximately 10 days to be received.

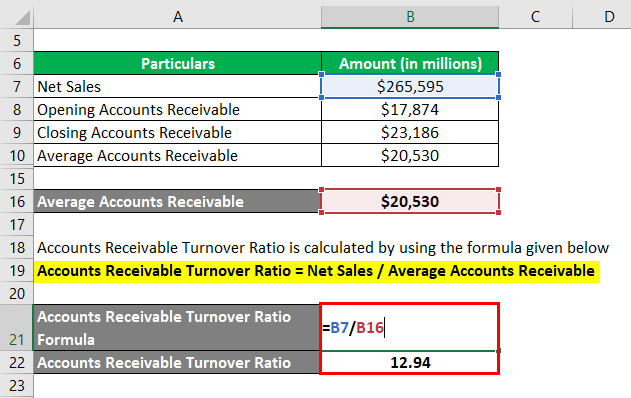

60000 2000 30. It uses to analyze the number of times that net credit sales during the period are collected based on the relationship between net credit sales during the period and averaged accounts receivable at the end of the period. Youll have to have both the income statement and balance sheet in front of you to calculate this equation. The receivable turnover ratio depicts that in how much time a company will be able to collect its accounts receivable. This means XYZ Inc. For analysis purposes accounts receivable tend to be an important metric because it reflects the companys overall cash and liquidity position. As you can see in the example below the accounts receivable balance is driven by the assumption that revenue takes approximately 10 days to be received. To calculate the accounts receivable turnover ratio we then divide net sales 60000 by average accounts receivable 2000. Balance Sheet Ratio Analysis. Receivable turnover is showing a very high ratio in the year 2017 it was 503 then there was a slight decrease in the year 2018 reaching 479 and remain at the same level in the year 2019 but again rising to 490 in the year 2020.

Youll have to have both the income statement and balance sheet in front of you to calculate this equation. The Accounts Receivable Turnover Ratio is calculated as follows. The receivables turnover ratio formula takes the credit sales divided by the average accounts receivables to find the number of turns. 60000 2000 30. Receivable turnover is showing a very high ratio in the year 2017 it was 503 then there was a slight decrease in the year 2018 reaching 479 and remain at the same level in the year 2019 but again rising to 490 in the year 2020. The higher this ratio is the faster your customers are paying you. Accounts Receivable Turnover is the efficiency ratio that directly measures the performance of receivable collecting activities over the year. This concludes our discussion of the three financial ratios using the current asset and current liability amounts from the balance sheet. An Accounts Receivable Turnover ratio of 45 means that it takes the company 45 days on average to collect its receivables. For example it helps in calculating the liquidity ratios including the current balance and quick ratio.

Risk-free investment such as a bank savings account the owner may be wiser to sell the company put the money in such a savings. Credit sales are found on the income statement not the balance sheet. Important Balance Sheet Ratios measure liquidity and solvency a businesss ability to. It uses to analyze the number of times that net credit sales during the period are collected based on the relationship between net credit sales during the period and averaged accounts receivable at the end of the period. An Accounts Receivable Turnover ratio of 45 means that it takes the company 45 days on average to collect its receivables. Has an accounts receivable turnover ratio of 30. Balance Sheet Ratio Analysis. The Accounts Receivable Turnover Ratio is calculated as follows. The receivables turnover ratio formula takes the credit sales divided by the average accounts receivables to find the number of turns. Quick ratio 25000 20000.

It uses to analyze the number of times that net credit sales during the period are collected based on the relationship between net credit sales during the period and averaged accounts receivable at the end of the period. As you can see in the example below the accounts receivable balance is driven by the assumption that revenue takes approximately 10 days to be received. An Accounts Receivable Turnover ratio of 45 means that it takes the company 45 days on average to collect its receivables. Credit sales are found on the income statement not the balance sheet. Balance sheet ratios are the. To calculate the accounts receivable turnover ratio we then divide net sales 60000 by average accounts receivable 2000. This means XYZ Inc. Youll have to have both the income statement and balance sheet in front of you to calculate this equation. Quick ratio 125 or 125 to 1 or 1251 If Betas quick assets are mostly cash and temporary investments it has a great quick ratio. Average 360 Converts the Accounts Receivable Turnover ratio into the Collection ARTurnover average number of days the company must wait for its Period Accounts Receivable to be paid.