The left or top side of the balance sheet lists everything the company owns. What do the various financial terms on. The company owns 18500 in Assets. Find updated content daily for balance sheets for dummies. The assets are made up of fixed and intangible assets bank stock and debtors. Ad Find Balance Sheets For Dummies. This one unbreakable balance sheet formula. How to read a balance sheet. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement. This includes 3000 from customers and 2500 in a loan.

Find updated content daily for balance sheets for dummies. Ad Find Balance Sheets For Dummies. Ad Find Balance Sheets For Dummies. The balance sheet presents the balances amounts of a companys assets liabilities and owners equity at an instant in time. The assets are made up of fixed and intangible assets bank stock and debtors. Its essentially a net worth statement for a company. A new sale adds an asset a new member of staff adds aliability and a new share issue adjusts theshareholder equity for example. A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worthThe balance sheet together with the income. This example balance sheet discloses the original cost of the companys fixed assets and the accumulated depreciation recorded over the years since acquisition of the assets which is standard practice. Its assets also known as debits.

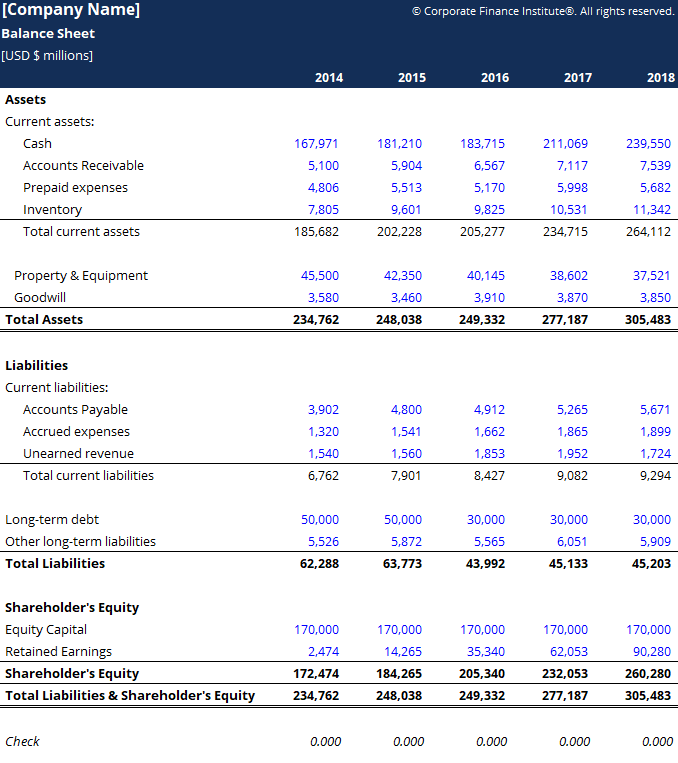

This example balance sheet discloses the original cost of the companys fixed assets and the accumulated depreciation recorded over the years since acquisition of the assets which is standard practice. What is a balance sheet and how can I read a balance sheet to learn more about the financial situation of a company. Find Content for balance sheets for dummies. A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worthThe balance sheet together with the income. The Balance Sheet example shows the following information. The assets are made up of fixed and intangible assets bank stock and debtors. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement. Its essentially a net worth statement for a company. Find Content for balance sheets for dummies. Find updated content daily for balance sheets for dummies.

Find updated content daily for balance sheets for dummies. This example balance sheet discloses the original cost of the companys fixed assets and the accumulated depreciation recorded over the years since acquisition of the assets which is standard practice. Ad Looking for balance sheets for dummies. Its essentially a net worth statement for a company. This includes 3000 from customers and 2500 in a loan. The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount. A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worthThe balance sheet together with the income. The company owns 18500 in Assets. Ad Looking for balance sheets for dummies. The company is owed 5500 of liabilities.

Ad Looking for balance sheets for dummies. Reading a balance sheet will help someone know how much asset a business owns and how much it owes to outsiders. A balance sheet is an indicator of the financial strength of a business. How to read a balance sheet. The assets are made up of fixed and intangible assets bank stock and debtors. A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worthThe balance sheet together with the income. What is a balance sheet and how can I read a balance sheet to learn more about the financial situation of a company. A balance sheet is only a snapshot in time and constantly changes as the elements that make up the balance sheet are in regular movement. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement. The left or top side of the balance sheet lists everything the company owns.