Acceptable current ratio values vary from industry to industry. The current ratio is a very common financial ratio to measure liquidity. You are required to calculate and interpret a quick ratio. Given working capital is 45000. Locate extract and analyse data from the published financial statements to provide a comprehensive analysis of a companys operations and performance. Calculation of Current assets and Current liabilities. It indicates whether the business can pay debts due within one year out of the current assets. The current ratio shows how many times over the firm can pay its current debt obligations based on its assets. It answers the question. Answer to Example 2.

Calculation of Current assets and Current liabilities. A current ratio of less than 1 could be an indicator the company will be unable to pay its current liabilities. Current liabilities Current liabilities You should note that this ratio is not expressed as a percentage. A high ratio implies that. Market Ratios PriceEarning Ratio. Compare NKE With Other Stocks. Acceptable current ratio values vary from industry to industry. It answers the question. Current ratio is equal to total current assets divided by total current liabilities. NIKE current ratio for the three months ending May 31 2021 was.

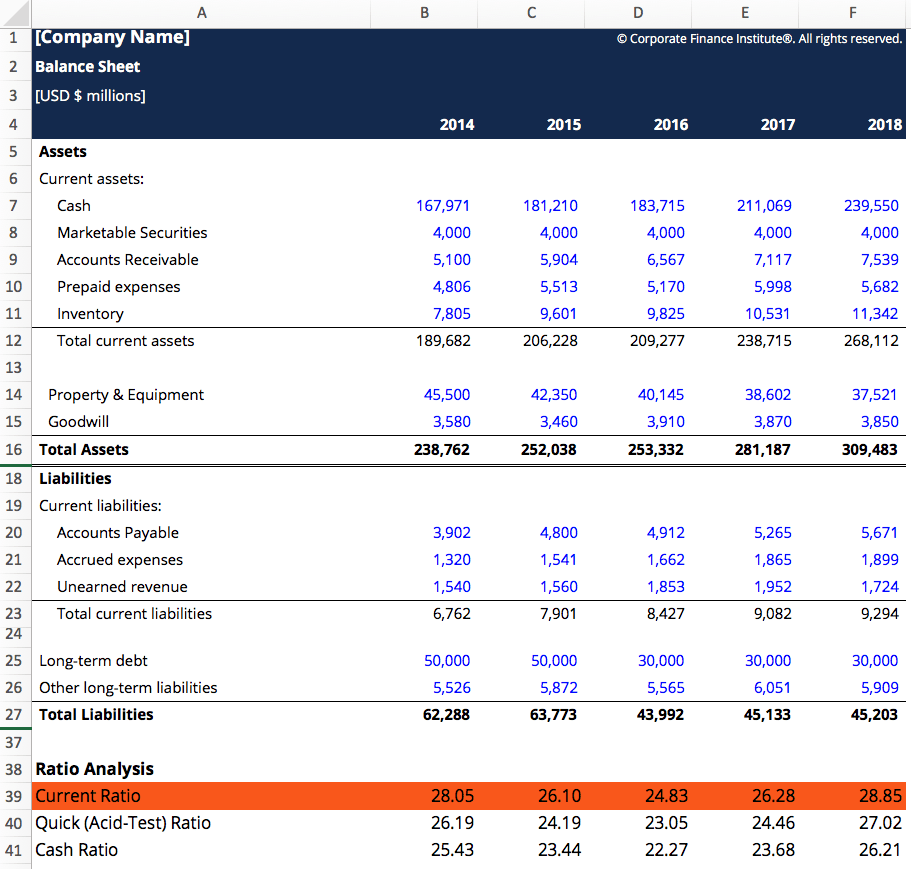

Current and historical current ratio for NIKE NKE from 2006 to 2021. Current ratio is equal to total current assets divided by total current liabilities. Market Ratios PriceEarning Ratio. A higher number in current assets would automatically result in a higher current ratio if current. The current ratio is the classic measure of liquidity. The sudden rise in current assets over the past two years indicates that Lowry has undergone a rapid expansion of its operations. Answer to Example 2. Given working capital is 45000. Current ratio also known as the working capital ratio The formula for calculating this ratio is Current assets OR Current assets. Current ratio is a financial ratio that measures whether or not a company has enough resources to pay its debt over the next business cycle usually 12 months by comparing firms current assets to its current liabilities.

A ratio greater than 1 means that the company has sufficient current assets to pay off short-term liabilities. It answers the question. The sudden rise in current assets over the past two years indicates that Lowry has undergone a rapid expansion of its operations. Acceptable current ratio values vary from industry to industry. Current Ratio formula is. The higher the resulting figure the more short-term liquidity the company has. Answer to Example 2. Again taking the example of Joe Kovers business we can state his current ratio as N16 000 N13 000 123. The first step in liquidity analysis is to calculate the companys current ratio. Current ratio 25 Inventory 40000.

Current ratio is a financial ratio that measures whether or not a company has enough resources to pay its debt over the next business cycle usually 12 months by comparing firms current assets to its current liabilities. The current ratio is a very common financial ratio to measure liquidity. Dividing the current assets by the current liabilities 181915 72310B would lead us to a current ratio of approximately 252 for Microsoft in the fiscal year that ended in June 2020. NIKE current ratio for the three months ending May 31 2021 was. Current ratio 25 Inventory 40000. The current ratio shows how many times over the firm can pay its current debt obligations based on its assets. Acceptable current ratio values vary from industry to industry. Compare NKE With Other Stocks. Current ratio 25 Current assets Current liabilities 25 Current assets 25 Current. A higher number in current assets would automatically result in a higher current ratio if current.