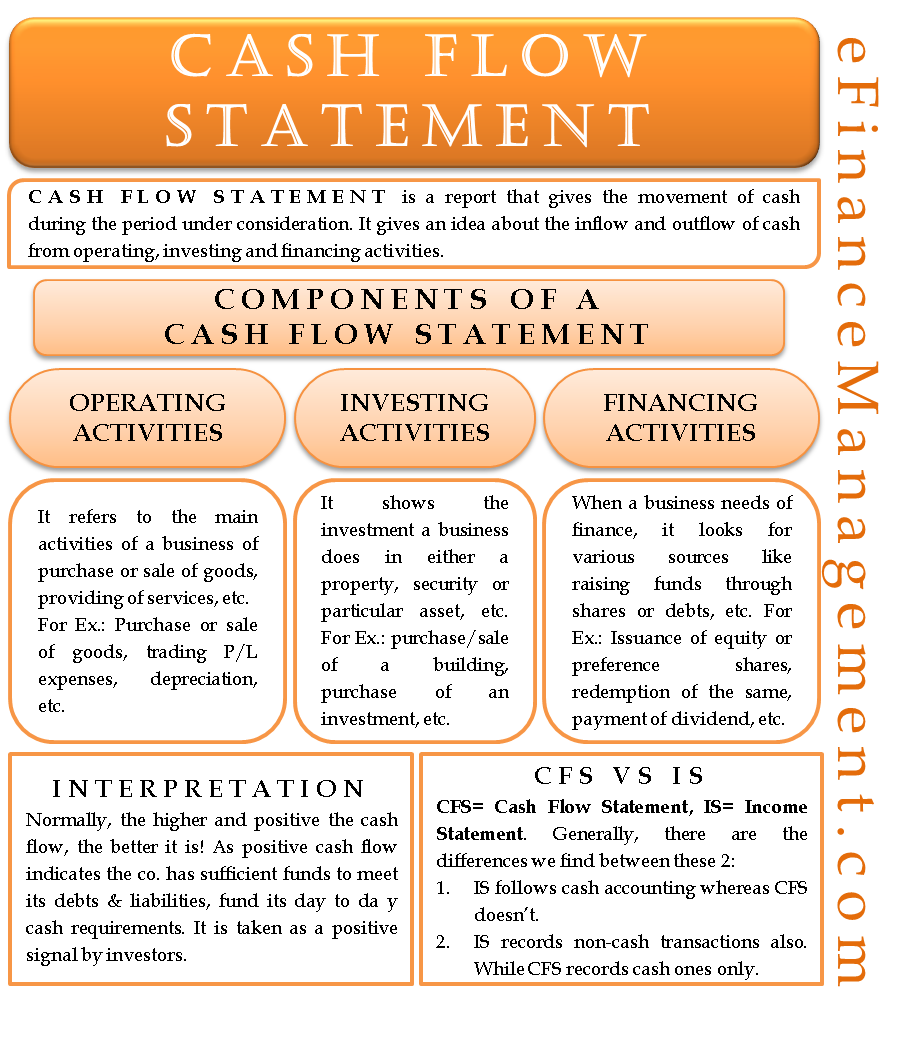

Any cash flows from the acquisition and disposal of long-term assets and other investments not included in cash equivalents. The main components of the cash flow statement are cash from operating activities cash from investing activities and cash from financing activities. Lets look at an example using Amazons 2017 financial statements. The statement of cash flows presents sources and uses of cash in three distinct categories. Any cash flows from current assets and current liabilities. Non-cash Investing and Financing Activities Changes in long-term liabilities short-term notes payable capital stock and treasury stock that do not involve cash Practice Problem 1 Identify which section of the statement of cash flows each of the following events would appear in operating investing and financing or in a separate schedule. Cash operations connected to noncurrent assets are included in investing activities. Merchandise inventory increased 18000. Financing activities activities involving the borrowing and repayment of debt long-term liabilities. Fixed asset investments and intangibles.

Merchandise inventory increased 18000. And total assets and liabilities. Consider Apples Fiscal Year 2017 10-K AAPL. Investing activities include purchases of physical assets investments in securities or the sale of securities or assets. Figure 122 Examples of Cash Flow Activity by Category Receipts of cash for dividends from investments and for interest on loans made to other entities are included in operating activities since both items relate to net income. Assets and liabilities for which the turnover is quick and the maturities are three months or less such as debt loans receivable and the purchase and sale of highly liquid investments Cash Flows from Operating Activities. The principal revenue-generating activities of an organization and other activities that are not investing or financing. Lets take a closer look at each of these items for Amazon. Financing activities activities involving the borrowing and repayment of debt long-term liabilities. Financing activities are the different transactions which involve movement of funds between the company and its investors owners or creditors to achieve long term growth and economic goals and have effect on the equity and debt liabilities present on the balance sheet.

Begins with net income which is then adjusted to the cash provided by operating activities. Cash operations connected to noncurrent assets are included in investing activities. To Eliminate investing and financing activities that their results are included in the income statement as we are calculating cash flow from only operating activities. Investing activities consist of payments made to purchase long-term assets as well as cash received from the sale of long-term assets. Operating activities investing activities and financing activities are the three types of cash flows. Assets and liabilities for which the turnover is quick and the maturities are three months or less such as debt loans receivable and the purchase and sale of highly liquid investments Cash Flows from Operating Activities. Financing activities activities involving the borrowing and repayment of debt long-term liabilities. Financing activities are the different transactions which involve movement of funds between the company and its investors owners or creditors to achieve long term growth and economic goals and have effect on the equity and debt liabilities present on the balance sheet. Cash flows from operating activities cash flows from investing activities and cash flows from financing activitiesFinancial statement users are able to assess a companys strategy and ability to generate a profit and stay in business by assessing how much a company relies on operating investing. Accounts payable tax liabilities and accrued expenses are common examples of liabilities for which a change in value is reflected in cash flow from operations.

A Sale of goods b Sale of Investment. Calculate the net cash provided or used by operating activities. Conversely some cash flows relating to operating activities are classified as investing and financing activities. They can be identified from changes in long-term liabilities and equity. Fixed asset investments and intangibles. Apple posted annual net income of 484 billion and net cash flows from operating activities of. Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable cash proceeds. Any cash flows from the acquisition and disposal of long-term assets and other investments not included in cash equivalents. Cash Flow from Investing Activities Example. Investing activities consist of payments made to purchase long-term assets as well as cash received from the sale of long-term assets.

Consider Apples Fiscal Year 2017 10-K AAPL. Lets take a closer look at each of these items for Amazon. They can be identified from changes in long-term liabilities and equity. Operating Profit Adjustment of Current Assets and Current Liabilities d All of the above. As you can see below investing activities include five different items which total to arrive at the net cash provided by used in investing. Investing activities activities involving the purchase and sale of long-term assets. A Sale of goods b Sale of Investment. Merchandise inventory increased 18000. The principal revenue-generating activities of an organization and other activities that are not investing or financing. Figure 122 Examples of Cash Flow Activity by Category Receipts of cash for dividends from investments and for interest on loans made to other entities are included in operating activities since both items relate to net income.