1 Gaining a good financial education 2 Creating and evaluating your budget 3 Applying for business loans and 4 Applying for personal loans. An estimate sent a week later seems lazy and provides the customer reason to shop about for a deal that was better. Balance sheets and income statements require different equations for interpreting and analyzing their data. You can access them via the links below. Search for small business for matching templates. This simple balance sheet template includes current assets fixed assets equity and current and long-term liabilities. 3 Roy J. An income statement is just one of the many documents included in a financial statement which also includes other financial reports like the balance sheet and cash flow statementAlso called the profit and loss statement the income statement focuses on the revenue and losses of the company basically providing the company an overall view of their gains and. The Trust aims to achieve its growth by re-investing any income arising from the. For instance the balance sheet equation Assets Liabilities Equity is the foundation for the whole balance sheet.

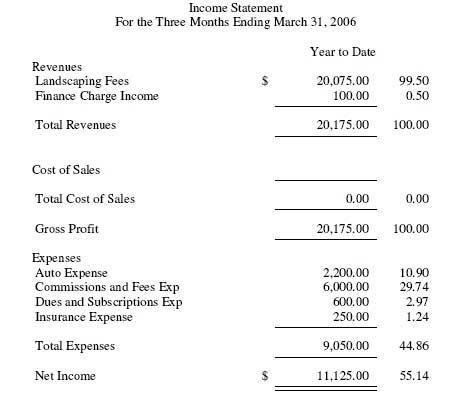

Creating and maintaining your own Personal Financial Statement is useful for 4 main purposes. Assets and liabilities are separated between current and long-term where current items are those items which will be realized or paid within one year of the balance sheet date. You can access them via the links below. Together with that the estimate displays the total amount of danger for each item in the list. Create an income statement that shows revenue and expense over a period of one year with this accessible small business income statement template. A balance sheet reports on your business assets liabilities and. Working capital money needed to fund day-to-day operations. An income statement is designed to report revenues and expenses for a specific period of time. 3 Roy J. This income statement template uses a preformatted structure to aid you in creating a professional income statement for your small business.

For instance the balance sheet equation Assets Liabilities Equity is the foundation for the whole balance sheet. This income statement template uses a preformatted structure to aid you in creating a professional income statement for your small business. Every time a company records a sale or an expense for bookkeeping purposes both the balance sheet and the income statement are affected by the. Grant Thornton Australia has prepared a number of Example Financial Statements for the year ended 31 December 2015 which have been tailored to suit a number of different scenarios. This equation shows you what your small business owns and owes. 3 Roy J. Sample Balance Sheet and Income Statement for Small Business By examining a sample balance sheet and income statement small businesses can better understand the relationship between the two reports. An income statement is designed to report revenues and expenses for a specific period of time. The balance sheet is a snapshot of the financial position of the company at the balance sheet date and shows the accumulated balance of the accounts. Assets and liabilities are separated between current and long-term where current items are those items which will be realized or paid within one year of the balance sheet date.

An income statement is just one of the many documents included in a financial statement which also includes other financial reports like the balance sheet and cash flow statementAlso called the profit and loss statement the income statement focuses on the revenue and losses of the company basically providing the company an overall view of their gains and. This equation shows you what your small business owns and owes. Balance sheet Simple Report on your assets and liabilities with this accessible balance sheet template. Grant Thornton Australia has prepared a number of Example Financial Statements for the year ended 31 December 2015 which have been tailored to suit a number of different scenarios. It lists all of your businesss assets and liabilities. If you already know why you need one and why you want to use Excel to create one then go ahead and download the template below. The contributions and opt-out payment are recognised as income and expenditure on a gross basis with no off-set. Lawyer or law firm and entered in both formats of the record the handwritten format as well as the electronicformat. If the records are created electronically in Word be sure to back up the documents and print a hard copy on a monthly basis. 3 Roy J.

Search for small business for matching templates. The contributions and opt-out payment are recognised as income and expenditure on a gross basis with no off-set. It lists all of your businesss assets and liabilities. This example of a simple balance sheet. The Trust aims to achieve its growth by re-investing any income arising from the. Consequently the partnership balance sheet set out at Example 4 does not show any provision of income tax because that is the liability of the partners rather than the liability of the partnership and it is likely that the paying of income tax by the partners will be brought to account by way of drawings in a way similar to the amount of. Carver Charitable Trust Statements of Financial Position April 30 2015 and 2014 Assets 2015 2014 Cash 634258 964769 Money market funds 3589994 2604416 Total cash and cash equivalents 4224252 3569185 Accrued investment income 461729 423079 Excise taxes receivable 16000 - Investments 313052316 303571366. If you already know why you need one and why you want to use Excel to create one then go ahead and download the template below. Assets and liabilities are separated between current and long-term where current items are those items which will be realized or paid within one year of the balance sheet date. The balance sheet provides a picture of the financial health of a business at a given moment in time.