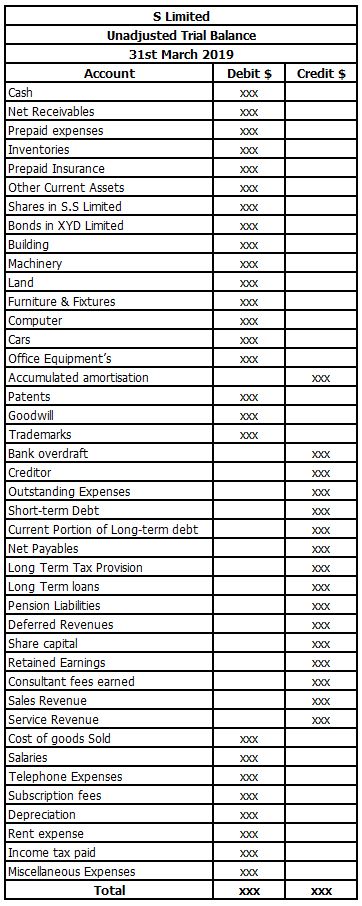

A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. If totals are not equal it means that an error was made in the recording andor posting process and should be investigated. For example if the company is 500 into the overdraft in the checking account the balance would be entered as -500 or 500 in the debit column. If the total of all debit values equals the total of all credit values then the accounts are correctat least as far as the trial balance can tell. The rule to prepare trial balance is that the total of the debit balances and credit balances. A trial balance includes a list of all general ledger account totals. Even when the debit and credit totals stated on the trial balance equal each other it does not mean that there are no errors in the accounts listed in the trial balance. Items that appear on the credit side of trial balance. Ledger balances are segregated into debit balances and credit balances. List the account balances in two columns.

The trial balance shows the list of all the accounts with both debit as well as credit balance at one place and helps in analyzing the position and transactions entered into during such time period at one place. Generally the trial balance format has three. It shows a list of all accounts and their balances either under the debit column or credit column. Since each transaction is listed in a way to ensure the debits equaled credits the quality should be maintained in the general ledger and the trial balance. A trial balance is the accounting equation of our business laid out in detail. Exclusive List of Items. Reserves and provisions also have credit balance. In a double-entry account book the trial balance is a statement of all debits and credits. The capital revenue and liability increases when it is credited and visa versa. In addition it should state the final date of the accounting period for which the report is created.

Exclusive List of Items. If the sum of debits does not equal the sum of credits an error has occurred and must be located. Since each transaction is listed in a way to ensure the debits equaled credits the quality should be maintained in the general ledger and the trial balance. The capital revenue and liability increases when it is credited and visa versa. List the account balances in two columns. Items that appear on the credit side of trial balance. A trial balance is a list and total of all the debit and credit accounts for an entity for a given period usually a month. Each account should include an account number description of the account and its final debitcredit balance. It shows a list of all accounts and their balances either under the debit column or credit column. The format of the trial balance is a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other.

Trial Balance is the statement or the record that lists down all of the closing account ledgers of the entity for a specific period of time. The list of debit and credit items in trial balance is as follows The debit side of it will feature entries from accounts like assets drawings accounts expense accounts cash balance bank balance losses purchases and sundry debtors among others. Assets expenses and losses always debit balance. The format of the trial balance is a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other. A trial balance is the accounting equation of our business laid out in detail. The trial balance is used to test the equality between total debits and total credits. For preparing trial balance with the help of balances of accounts we should remember following things. Generally capital revenue and liabilities have credit balance so they are placed on the credit side of trial balance. In addition it should state the final date of the accounting period for which the report is created. Prepare a Trial Balance 2-28.

A trial balance is a list and total of all the debit and credit accounts for an entity for a given period usually a month. It shows a list of all accounts and their balances either under the debit column or credit column. Items that appear on the credit side of trial balance. Generally capital revenue and liabilities have credit balance so they are placed on the credit side of trial balance. It has our assets expenses and drawings on the left the debit side and our liabilities revenue and owners equity on the right the credit side. A trial balance is a list of the balances of all of a businesss general ledger accounts. Reserves and provisions also have credit balance. For example if the company is 500 into the overdraft in the checking account the balance would be entered as -500 or 500 in the debit column. A trial balance includes a list of all general ledger account totals. Left column Debits Right column Credits List the accounts in the same order as the chart of accounts.