A three-statement model links the income statement the balance sheet and the cash flow statement of a company providing a dynamic framework to help evaluate different scenarios. 3 Statement Model 3 Statement Model A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. Derive a forecast cash flow statement based on a forecast income statement and balance sheet. While accounting enables us to understand a companys historical financial statements forecasting those financial statements enables us to explore how a company will perform under a variety of. Net income on the income statement grows retained earnings on the balance sheet. This course includes a pre-populated DCF model as the focus of the course is on linking a three statement model. Build the income statement. 3 Statement Model in Excel. An Assumptions Section with key drivers for the business. However at a minimum the following items are required to be presented on the income statement.

Fill in the assumptions. Derive a free cash flow statement that can be used for equity valuation. Checkout Added to cart. A three-statement model links the income statement the balance sheet and the cash flow statement of a company providing a dynamic framework to help evaluate different scenarios. The model allows you to enter your assumptions in the yellow cells and based on. If youre building a financial model in Excel its critical to be able to quickly link the three statements. This model has an assumptions and drivers section which is used to build the forecast in the three financial statements. Complete the IS and BS. Based on these financials the model also estimates the value of your company using the DCF method Income approach. 3 Statement Model in Excel.

A three statement financial model connects the income statement balance sheet and cash flow statement into one dynamically linked model. I have found that if the principle relationships linking the three primary financial statements are well known it makes understanding the rest of the model an easier exercise. Then filling out the entire income statement filling out the parts of the balance sheet that we can actually complete fill out the entire cash flow statement and then go back and complete the rest of the balance sheet and then check our work and answer the case study questions at the end. Build the balance sheet. This video will follow the procedure outlined in the previous video titled Overview of the. This is an Excel Model and FREE to Download. The 3 Statement Model is the foundation of any financial model. Included in the template you will find. A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. Be used to report income statement information.

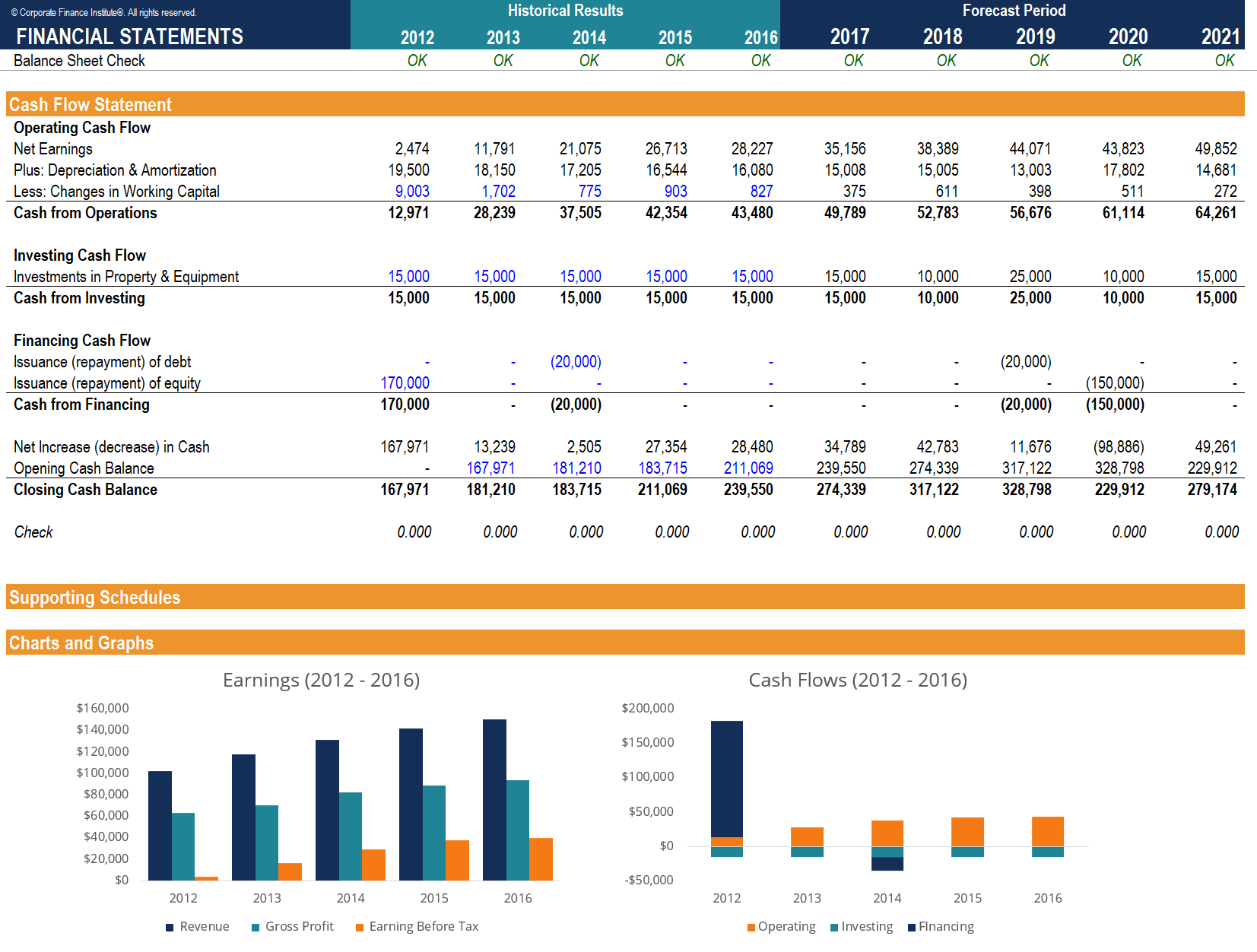

A three-statement model links the income statement the balance sheet and the cash flow statement of a company providing a dynamic framework to help evaluate different scenarios. The Common Size income statement is a four-section template that you can rely on for an accurate financial analysis. Build the income statement. INCOME STATEMENT blue arrow. Complete the cash flow statement. Net income on the income statement grows retained earnings on the balance sheet. The Income Statement Balance Sheet and Cash Flow Statement. This is an Excel Model and FREE to Download. Build charts and graphs. In order to do this there are a few basic steps to follow.

The Income Statement Balance Sheet and Cash Flow Statement. The model is built in a single tab worksheet format. Key drivers for modeling. In order to do this there are a few basic steps to follow. An Assumptions Section with key drivers for the business. 3 Statement Model in Excel. The model allows you to enter your assumptions in the yellow cells and based on. 3 statement models are the foundation on which more advanced financial models are built such as discounted cash flow DCF models DCF Model Training Free Guide A DCF model is a specific type of financial model. Checkout Added to cart. This is an Excel Model and FREE to Download.