Assertions regarding the recognition measurement and presentation of assets liabilities equity income expenses and disclosures in accordance with the applicable financial reporting framework eg. Existence or occurrence. Balance Sheet Assertions Balance sheet or statement of financial position has 4 assertions. A cash flow statement tells you how much cash you have on. The balance sheet tells you where you are while the income statement tells you how you got there. In the absence of information about the date of repayment of a liability then it may be assumed. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities. In preparing financial statements management is making implicit or explicit claims ie. Prepare balance sheet for F. It is the third assertion type that can fall under both transaction-level assertions and account balance assertions.

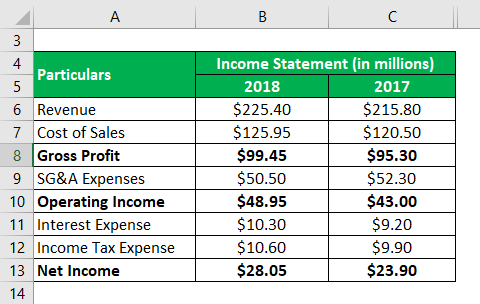

Green as at 31 March 2015. The balance sheet tells you where you are while the income statement tells you how you got there. Liabilities recognized in the financial statements represent the actual obligations of the entity. The following trial balance is prepared after preparation of income statement for F. The assets equity balances and liabilities have been valued appropriately. The balance sheet is like a photo of your bank account and. It is the third assertion type that can fall under both transaction-level assertions and account balance assertions. The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. A cash flow statement tells you how much cash you have on. Also sometimes called a net income statement or a statement of earnings the income statement is one of the three most important financial statements in financial accounting along with the balance sheet and the cash flow statement or statement of cash flows.

In preparing financial statements management is making implicit or explicit claims ie. Presentation and Disclosure Assertions. The balance sheet is like a photo of your bank account and. The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. The balance sheet income statement. A cash flow statement tells you how much cash you have on. The balance sheet and income statement are both part of a suite of financial statements that tell the story of a businesss history. Assertions regarding the recognition measurement and presentation of assets liabilities equity income expenses and disclosures in accordance with the applicable financial reporting framework eg. The income statement is one of three statements. The difference is that occurrence is for income.

Also sometimes called a net income statement or a statement of earnings the income statement is one of the three most important financial statements in financial accounting along with the balance sheet and the cash flow statement or statement of cash flows. The balance sheet is like a photo of your bank account and. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities. The difference is that occurrence is for income. Prepare balance sheet for F. Liabilities recognized in the financial statements represent the actual obligations of the entity. The balance sheet income statement. Write a one- or two-sentence explanation of each matching entry. From the income statement we already know that the company had a net income of 4500 for the quarter ending March 31 2013. The assets equity balances and liabilities have been valued appropriately.

Existence or occurrence. Prepare balance sheet for F. At the beginning of this quarter the balance. A cash flow statement tells you how much cash you have on. Match each of these five assertions with all of the input control goals that apply. The balance sheet income statement. Green as at 31 March 2015 in both horizontal and vertical style. A balance sheet tells you everything your business is holding on to at a particular point in timeyour assets and liabilities. The following trial balance is prepared after preparation of income statement for F. The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time.