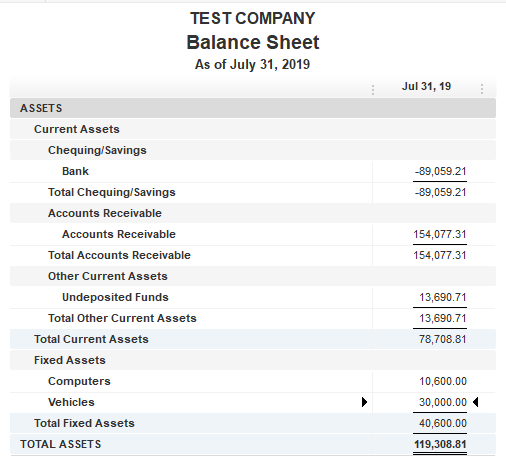

A balance sheet is a summary of all of your business assets what the business owns and liabilities what the business owes. Amount to be received from customers to whom goods were sold on credit amount to be received from officers to whom the firm gave loans etc. On the left side of a balance sheet assets will typically be classified into current assets and non-current long-term assets. The balance sheet includes information about a companys assets and liabilities. Your intangible assets will only appear on your balance sheet if theyre acquired by your small business. The balance sheet is commonly used for a great deal of financial analysis of a business performance. A balance sheet lays out the ending balances in a companys asset liability and equity accounts as of the date stated on the report. These fundamentals are important before we proceed to. Revenue Expenses Net profitloss. Depending on the company this might include short-term assets such as cash and accounts receivable.

Users need to know that a companys classified balance sheet shows important subtotals in related groupings for the assets liabilities and owners equity of the company. The groupings include current assets and noncurrent assets as well as current liabilities and noncurrent liabilities. A balance sheet is a summary of all of your business assets what the business owns and liabilities what the business owes. Common line items found in this section of the balance sheet include. It also can help you stay aware of their worth. Balance sheet consist of assets fixed and current liabilities short and long term and owners equity. Add Total Liabilities to Total Shareholders Equity and Compare to Assets. The main categories of assets are usually listed first and normally in order of liquidity. It also shows owners equity. Creating an income statement requires some basic math.

Including your intangible assets on your balance sheet can help you avoid mismanaging them. A balance sheet is a summary of all of your business assets what the business owns and liabilities what the business owes. At any particular moment it shows you how much money you would have left over if you sold all your assets and paid off all your debts ie. Amount to be received from customers to whom goods were sold on credit amount to be received from officers to whom the firm gave loans etc. To ensure the balance sheet is balanced it will be necessary to compare total assets against total liabilities plus equity. The groupings include current assets and noncurrent assets as well as current liabilities and noncurrent liabilities. Depending on the company this might include short-term assets such as cash and accounts receivable. Add Total Liabilities to Total Shareholders Equity and Compare to Assets. A balance sheet is a financial statement included in company accounts. Assets including cash stock equipment money owed to business goodwill.

The assets side shows the tools the company has at its disposal to operate the business and the liabilitiesowners equity side shows how the company financed these assets. These fundamentals are important before we proceed to. A balance sheet is a summary of all of your business assets what the business owns and liabilities what the business owes. Balance sheet consist of assets fixed and current liabilities short and long term and owners equity. A balance sheet is usually completed at the end of a month or financial year and is an indicator of the financial health of your business. A balance sheet is a financial statement included in company accounts. The groupings include current assets and noncurrent assets as well as current liabilities and noncurrent liabilities. Creating an income statement requires some basic math. The balance sheet is commonly used for a great deal of financial analysis of a business performance. A standard company balance sheet has three parts.

Liabilities including loans credit card debts tax liabilities money owed to suppliers. Creating an income statement requires some basic math. It also shows owners equity. As such it provides a picture of what a business owns and owes as well as how much as been invested in it. On the left side of a balance sheet assets will typically be classified into current assets and non-current long-term assets. In contrast the balance sheet aggregates multiple accounts summing up the number of assets liabilities and shareholder equity in the accounting records at a specific time. Add Total Liabilities to Total Shareholders Equity and Compare to Assets. Assets liabilities and ownership equity. According to money measurement convention financial statement are prepared by. On this financial statement is included fixed assets current assets short term liabilities long-term liabilities provisions capital and reserves.